Get ready for the

2024 AlphaCore Wealth Summit

Sept. 19, 2024 | La jolla, CA

AlphaCore’s Biggest Event of the Year

During AlphaCore’s flagship educational event, attendees will hear from who we believe are the foremost thought leaders in the wealth management industry. We’ll discuss innovative investment strategies and planning tactics to potentially strengthen portfolios and protect wealth over time.

The 2024 Summit will take place at The Conrad Prebys Performing Arts Center.

Register for 2024

Watch Highlights from the 2023 Summit

Highlight Reel

David Stubbs

MANAGING DIRECTOR, SENIOR INVESTMENT STRATEGIST

Blackstone Private Wealth

Highlight Reel

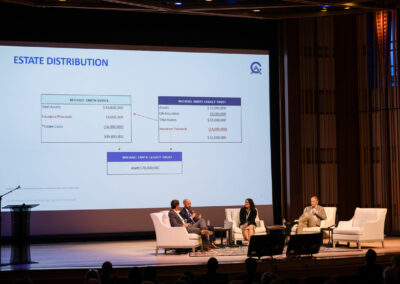

Fireside Chat

Highlight Reel

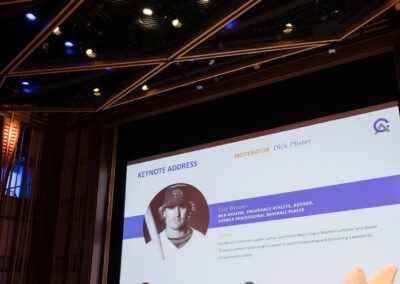

Eric Byrnes

MLB ANALYST, ENDURANCE ATHLETE, AUTHOR, FORMER PROFESSIONAL BASEBALL PLAYER

Exclusive Access

Full Event Videos for 2023 Attendees!

Please note:

Full presentations require a password to view.

Please reach out to your advisor or email us at events@alphacore.com for access.